Basis0439

Well-known member

- Thread starter

- #1

Just wondering a few things:

1. are all terms of loans the same through Ford Canada? Can the Dealer alter things (such as open/closed loans). I'd like to know what to be wary of.

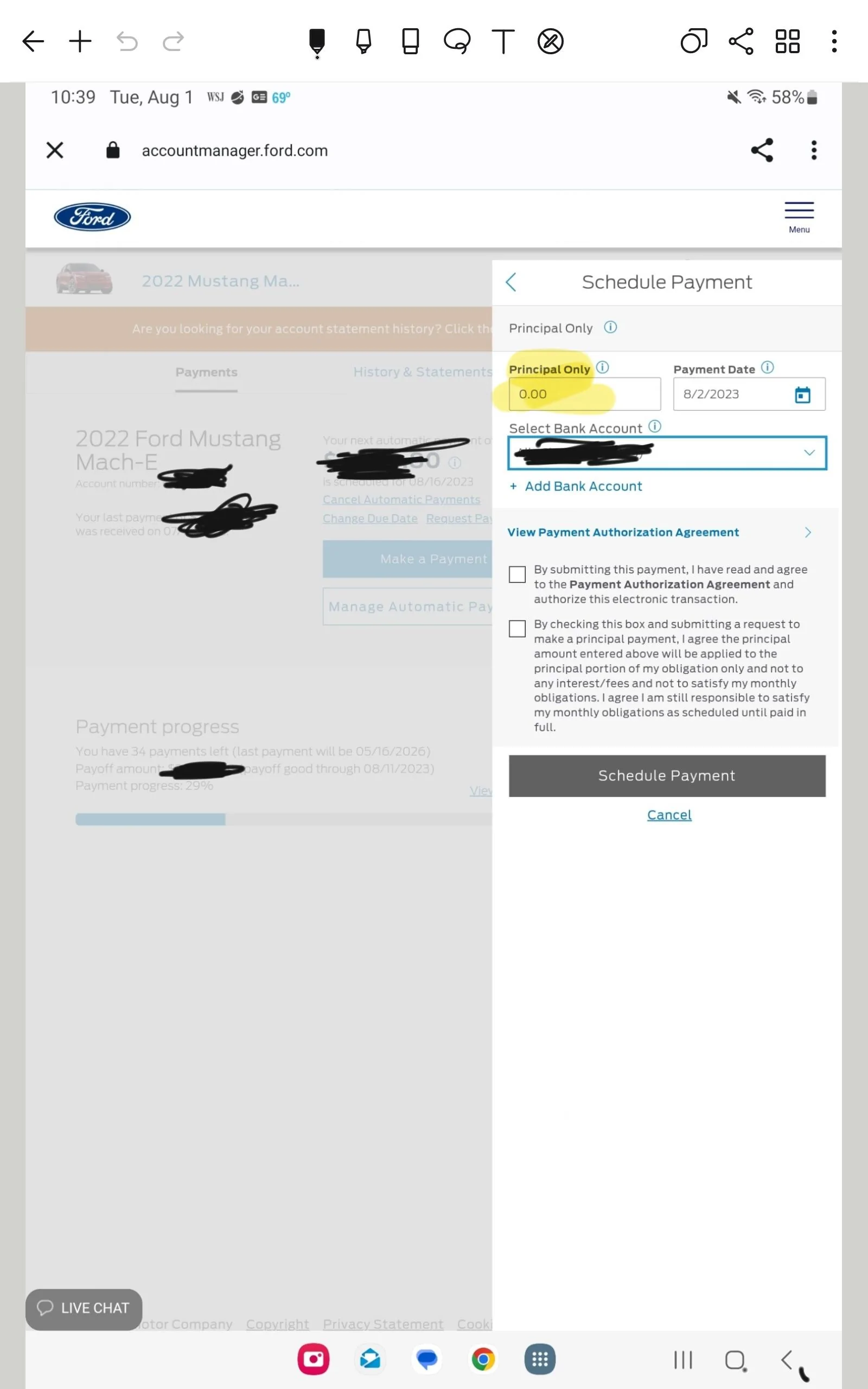

2. How easy is it to put $$ to the principal? Can I just set up my Ford Canada account as a payee and pay towards principal?

Anything else I should be aware of prior to sitting down with the Finance team at my Ford dealership?

Thank you

1. are all terms of loans the same through Ford Canada? Can the Dealer alter things (such as open/closed loans). I'd like to know what to be wary of.

2. How easy is it to put $$ to the principal? Can I just set up my Ford Canada account as a payee and pay towards principal?

Anything else I should be aware of prior to sitting down with the Finance team at my Ford dealership?

Thank you

Sponsored