Vulnox

Well-known member

- Joined

- Mar 19, 2021

- Threads

- 6

- Messages

- 525

- Reaction score

- 398

- Location

- Livonia, MI

- Vehicles

- 2024 F-150 Lightning Platinum, 2025 Mustang Mach-e Premium AWD

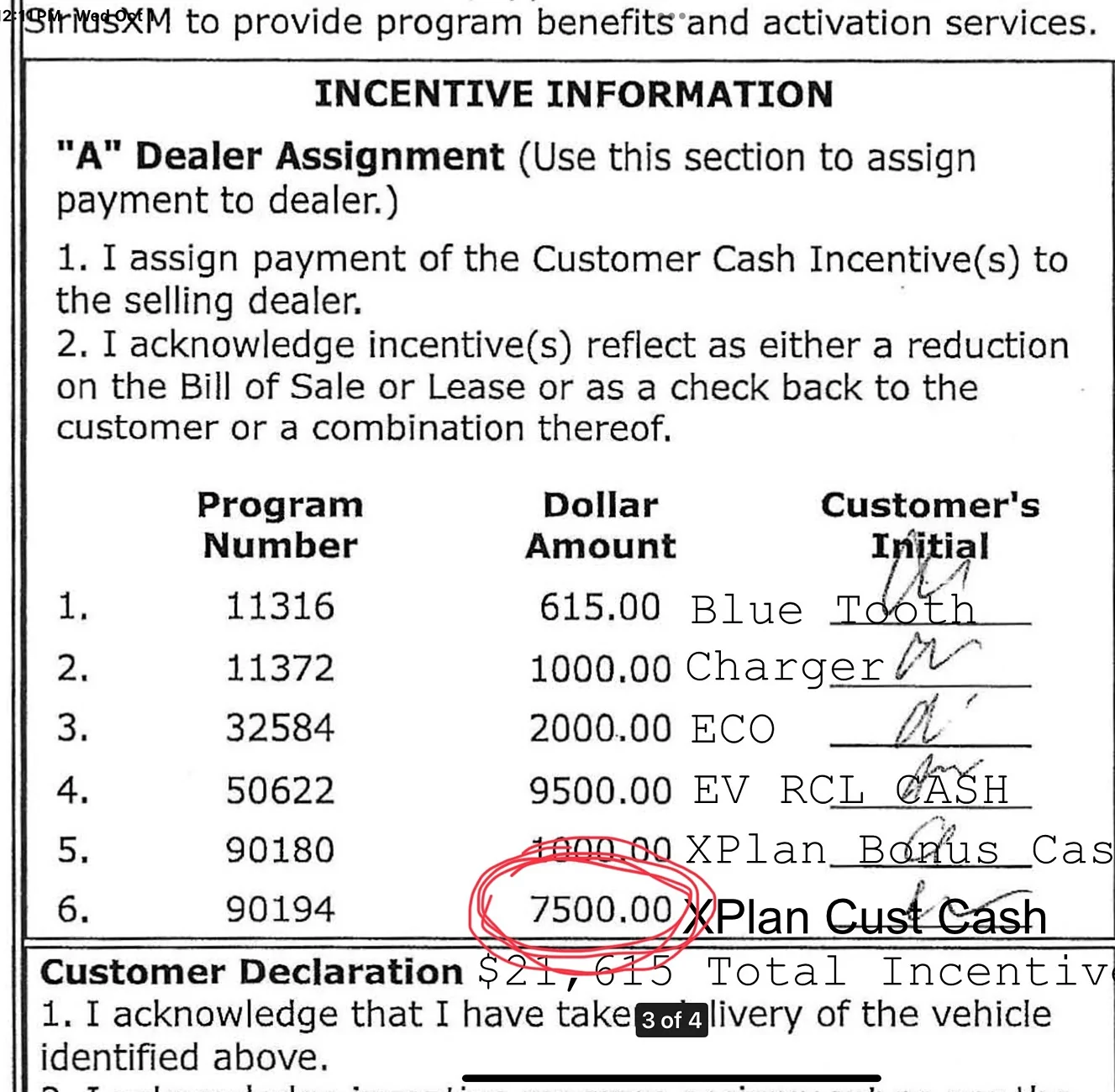

This is the incentive to offset EFC16728, not the notice itself. But in either case there may be an option if the dealer reads the notice I mentioned.Select Inventory Offer

Available for: Cash Purchase, Finance Requirements and Restrictions:

2025 F-150 Lightning VIN Specific RBC - EFC16728 (#32826). Eligible buyers may receive 2025 F-150 Lightning VIN Specific RBC - EFC16728 on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 09/30/2025. Residency restrictions apply. See dealer for qualifications and complete details.

Customer $ Offer$7,500

Start07/18/2025

End10/01/2025

Sponsored