Zprime29

Well-known member

- First Name

- Brandon

- Joined

- Jul 26, 2022

- Threads

- 42

- Messages

- 2,484

- Reaction score

- 2,644

- Location

- Tucson, AZ

- Vehicles

- 2022 Lightning ER, 2025 XC90 Recharge

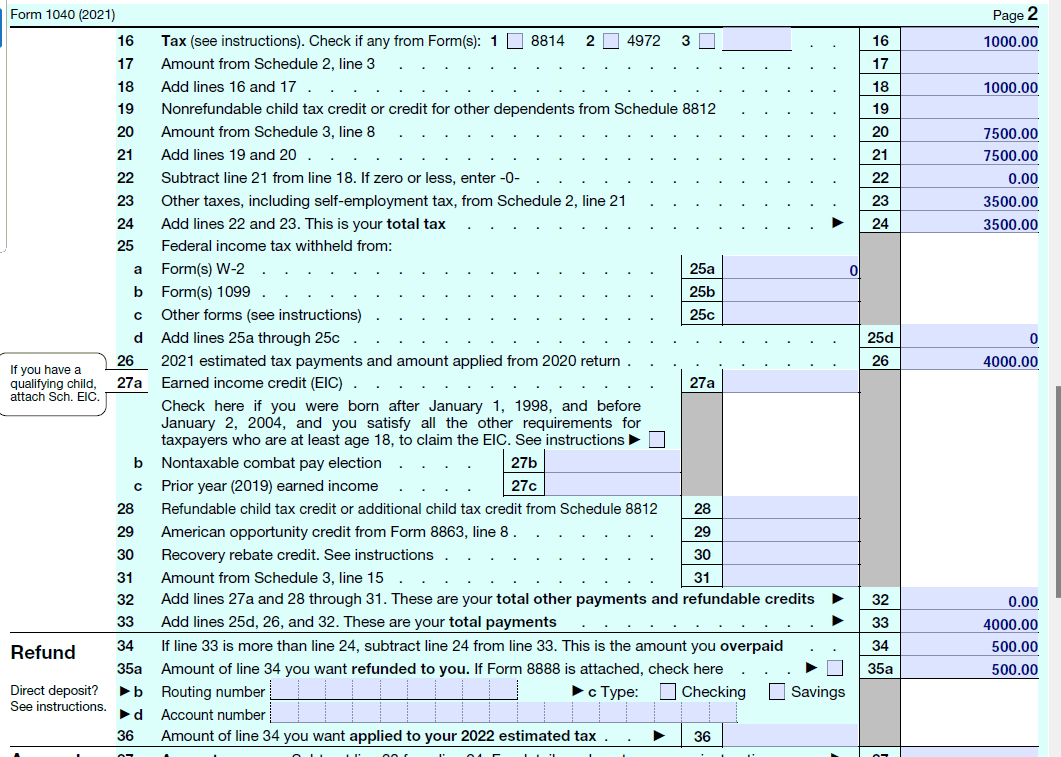

AMT won't apply to me, I checked my 2022 return and had $7200 in liability. I had a decent pay bump and am fairly certain I'll be over $7500 for 2023, but not much more than that. I'm well within the income limit so no concern there. I was hoping the EVSE credit could be stacked in addition to the EV credit, oh well...it won't break the bank. Only spent $1k on install and since the FCSP can't be claimed I'm not really out that much.It’s more complicated than that. My EVSE credit was only $300 and I had the extra liability but still didn’t get it. AMT is tricky.

Sponsored