Tclark5

Well-known member

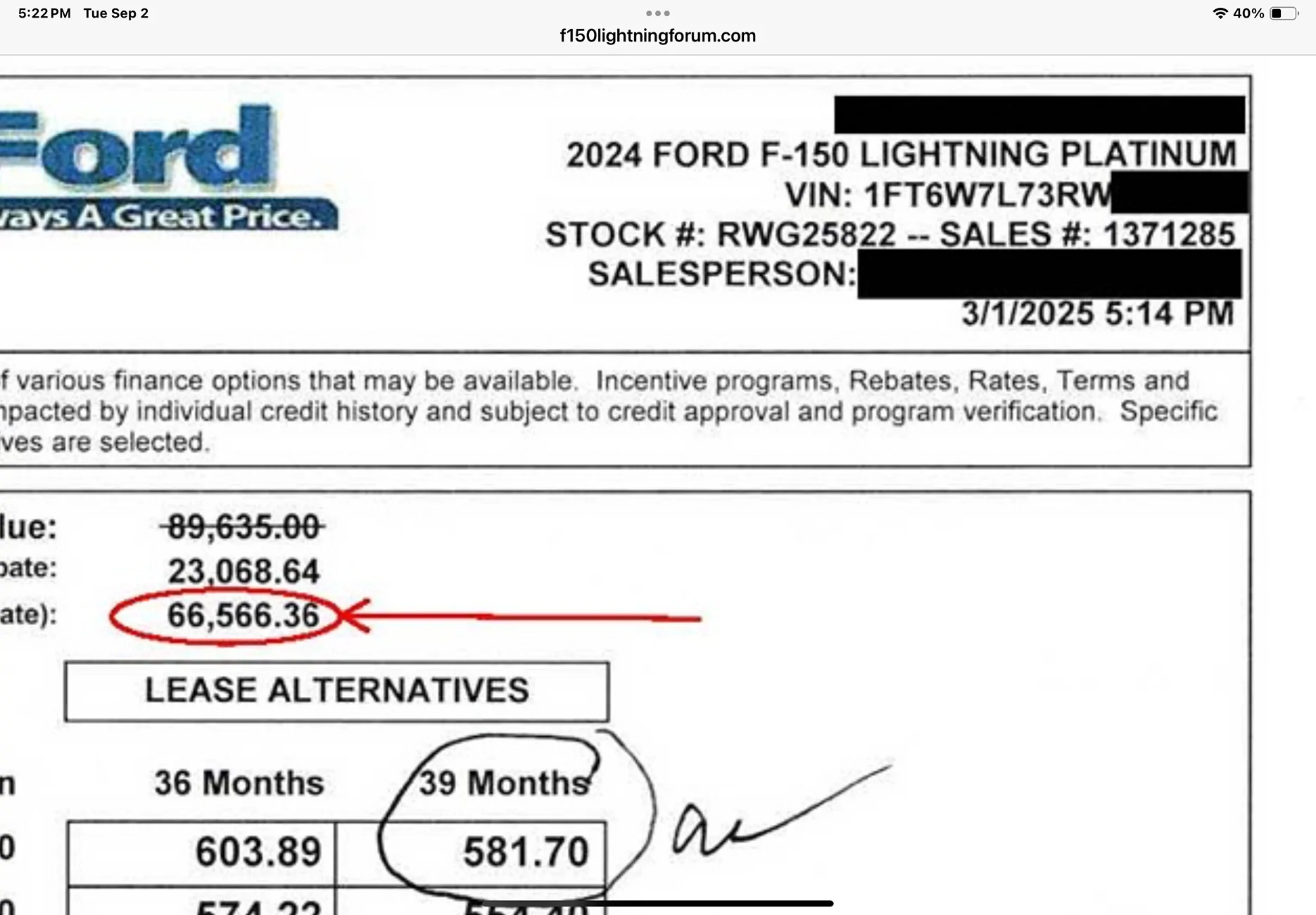

They changed the rules for 2024 tax year. 7500.00 taken off sale price, dealer ship has to file vin within 3 days to get their money back. Same for the used EV’s. A dealer in FT Lauderdale screwed me out of my 4000 for a used RV under the 25,000 threshold. I contacted the IRS, nothing I can do except small claims against the dealer.granted I bought my Lariat n September 2023 and I paid cash. My dealer never heard of such paperwork. I got my rebate last year simply by filling out form 8936 and entering my VIN.

Sponsored