chl

Well-known member

- First Name

- CHRIS

- Joined

- Dec 16, 2022

- Threads

- 7

- Messages

- 1,984

- Reaction score

- 1,210

- Location

- alexandria virginia

- Vehicles

- 2001 FORD RANGER, 2023 F-150 LIGHTNING

- Thread starter

- #16

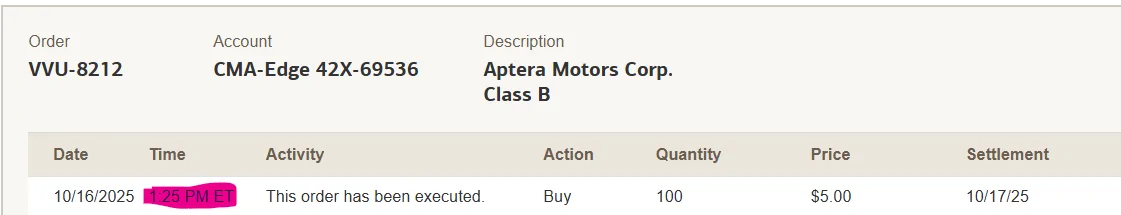

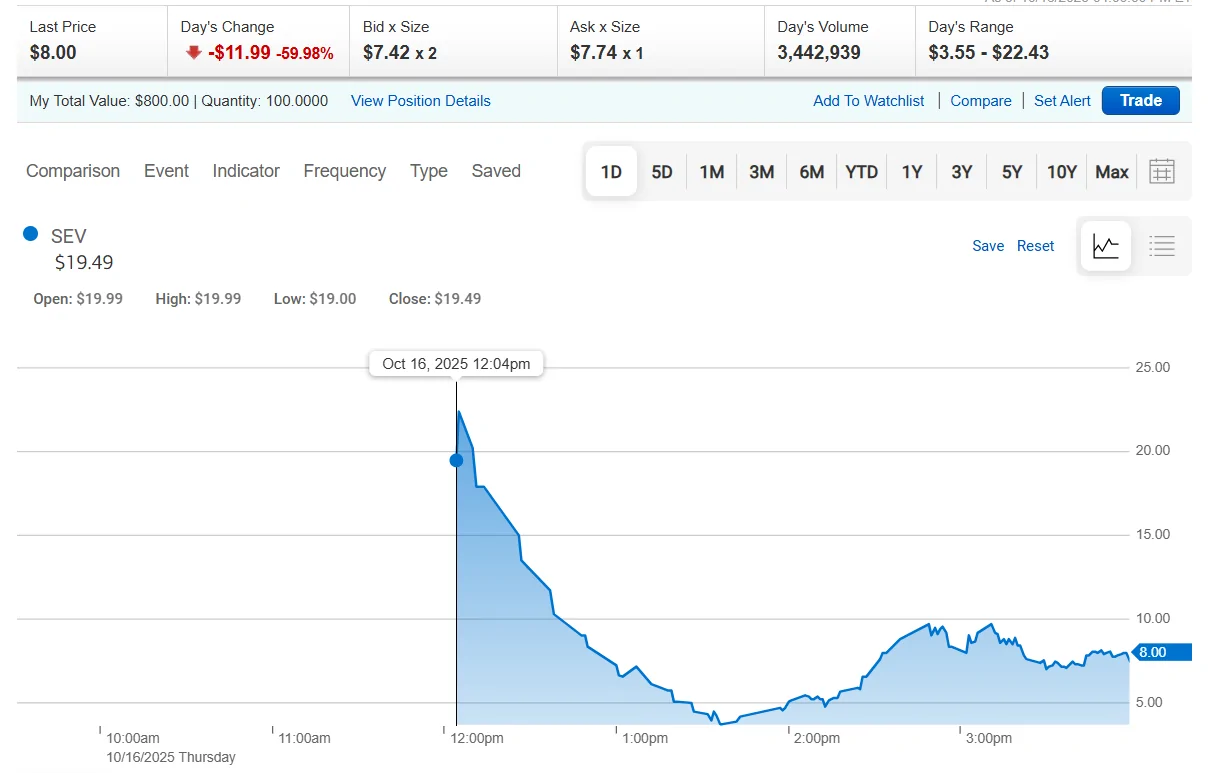

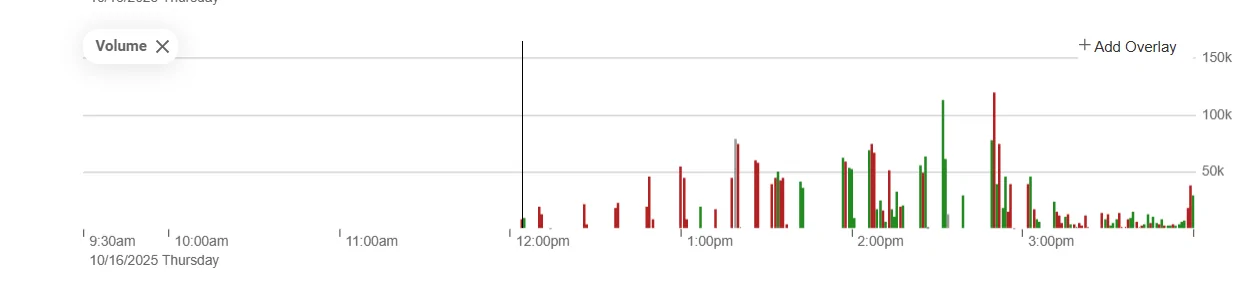

Good call.I decided to take a gamble, posted a low ball order for 100 shares @ $5.00, I was surprised it executed, based on the above 52 week low/high shown this morning.

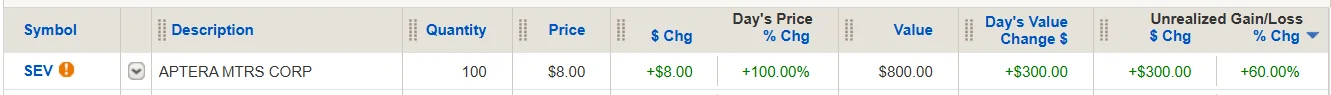

Now I've already made 60% gain......... I'll hold it and see where this goes.

I kind of expected it to go low on the first day and remain low for some time which was why I was in no hurry to transfer shares to my broker.

Before going public some people were selling their shares to others at around $40 per which I assume it why they initially valued the stock at $44.40 per. I received 340 shares for my $10,710 'investment' made back in 2023 as part of the 'accelerator' program to be guaranteed one of the first 2,000 produced.

But a company that has not manufactured their automobile for sale to the public yet is hard to value so that price seemed overly optimistic.

Assuming they are able to start production and delivery in the next few months, which seems to be the plan, I would expect the price to adjust upwards quite a bit.

But I think it will be quite a while before they reach the $44.40 per valuation they proposed.

They have a big backlog of potential orders just waiting for the day.

But so did Ford and Tesla, and upwards of 80% of those 'evaporated' when the trucks were finally available.

Sales in California when they begin will probably be the bell weather.

I am looking forward to owning one someday - fingers crossed!

Sponsored