jimfigler

Well-known member

- First Name

- Jim

- Joined

- Sep 13, 2022

- Threads

- 36

- Messages

- 1,131

- Reaction score

- 952

- Location

- Orchard park, NY

- Vehicles

- 23 Lightning Lariat ER, 21 Corvette Convertible

- Thread starter

- #1

For the 118th, I expect HR 1 will be introduced to repeal the Inflation Reduction Act.when the 118th congress is seated

HR 1 will be about illegal immigration. Kevin McCarthy already announced it.For the 118th, I expect HR 1 will be introduced to repeal the Inflation Reduction Act.

https://www.google.com/amp/s/amp.cn...mccarthy-interview-border-security/index.html"The first thing you'll see is a bill to control the border first," McCarthy told CNN, when asked for specifics about his party's immigration plans.

The the IRA was passed and changes the prior law. What is being discussed here is a a theoretical change to the IRA.So what it means if the bill is delayed. The existing tax conditions will continue (only first 200k cars per manufacturer are eligible for 7500) ?

From the department of redundancy department! ??

Shown Here: Introduced in House (11/10/2022)

H. R. 9289

117th CONGRESS 2d Session

To amend the Internal Revenue Code of 1986 to temporarily suspend application of the requirement that final assembly of vehicles occur within North America for purposes of the clean vehicle credit, and for other purposes.

IN THE HOUSE OF REPRESENTATIVES

November 10, 2022

Ms. Sewell (for herself, Mr. Cleaver, and Mr. Swalwell) introduced the following bill; which was referred to the Committee on Ways and Means

A BILL

To amend the Internal Revenue Code of 1986 to temporarily suspend application of the requirement that final assembly of vehicles occur within North America for purposes of the clean vehicle credit, and for other purposes.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the “Affordable Electric Vehicles for America Act of 2022”.

SEC. 2. ADJUSTMENT OF CERTAIN REQUIREMENTS FOR CLEAN VEHICLE CREDIT.

(a) Final Assembly.—Subparagraph (G) of section 30D(d)(1) of the Internal Revenue Code of 1986, as added by section 13401(b) of Public Law 117–169, is amended by inserting “in the case of any motor vehicle sold after December 31, 2025,” before “the final assembly”.

(b) Critical Minerals And Battery Components.—Section 30D of the Internal Revenue Code of 1986, as amended by section 13401 of Public Law 117–169, is amended—

(1) in subsection (d)(7)—

(A) in subparagraph (A), by striking “December 31, 2024” and inserting “December 31, 2025”, and

(B) in subparagraph (B), by striking “December 31, 2023” and inserting “December 31, 2024”, and

(2) in subsection (e)—

(A) in paragraph (1)(B)—

(i) in clause (i), by striking “after the date on which the proposed guidance described in paragraph (3)(B) is issued by the Secretary and before January 1, 2024” and inserting “during calendar year 2026”,

(ii) in clause (ii), by striking “2024” and inserting “2027”,

(iii) in clause (iii), by striking “2025” and inserting “2028”,

(iv) in clause (iv), by striking “2026” and inserting “2029”, and

(v) in clause (v), by striking “December 31, 2026” and inserting “December 31, 2029”,

(B) in paragraph (2)(B)—

(i) in clause (i), by striking “after the date on which the proposed guidance described in paragraph (3)(B) is issued by the Secretary and before January 1, 2024” and inserting “during calendar year 2026”,

(ii) in clause (ii), by striking “2024 or 2025” and inserting “2027 or 2028”,

(iii) in clause (iii), by striking “2026” and inserting “2029”,

(iv) in clause (iv), by striking “2027” and inserting “2030”,

(v) in clause (v), by striking “2028” and inserting “2031”, and

(vi) in clause (vi), by striking “December 31, 2028” and inserting “December 31, 2031”, and

(C) in paragraph (3)(B), by striking “December 31, 2022” and inserting “December 31, 2025”.

(c) Effective Date.—The amendments made by this section shall take effect as if included in the enactment of section 13401 of Public Law 117–169.

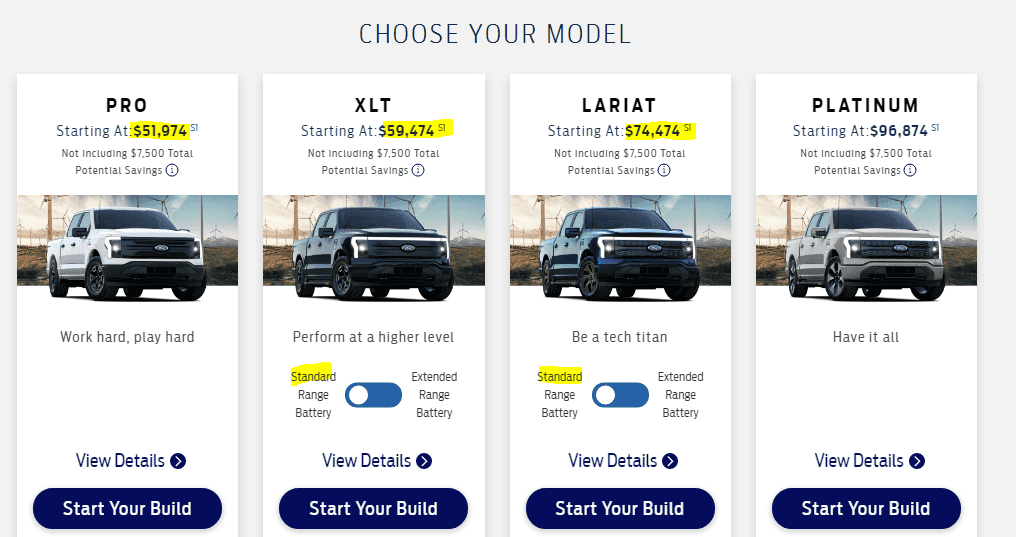

IMHO, it will be the window sticker price of the trim level plus options, so this credit is only going to work for PRO-SR, XLT-SR and Lariat-SR trim's, while the ER's trims will not be qualified, until Ford allows a PRO-ER order to retail consumers. But this is only my pragmatic opinion, still not sure if the REV/PROC's will be detailed enough to definitively answer the concern@TaxmanHog Whats your opinion on what MSRP they will use? If they use base then everything except the platinum would qualify, I'm sure us 23 ER people are praying this is the case lol.