EdwinT

Well-known member

- Thread starter

- #16

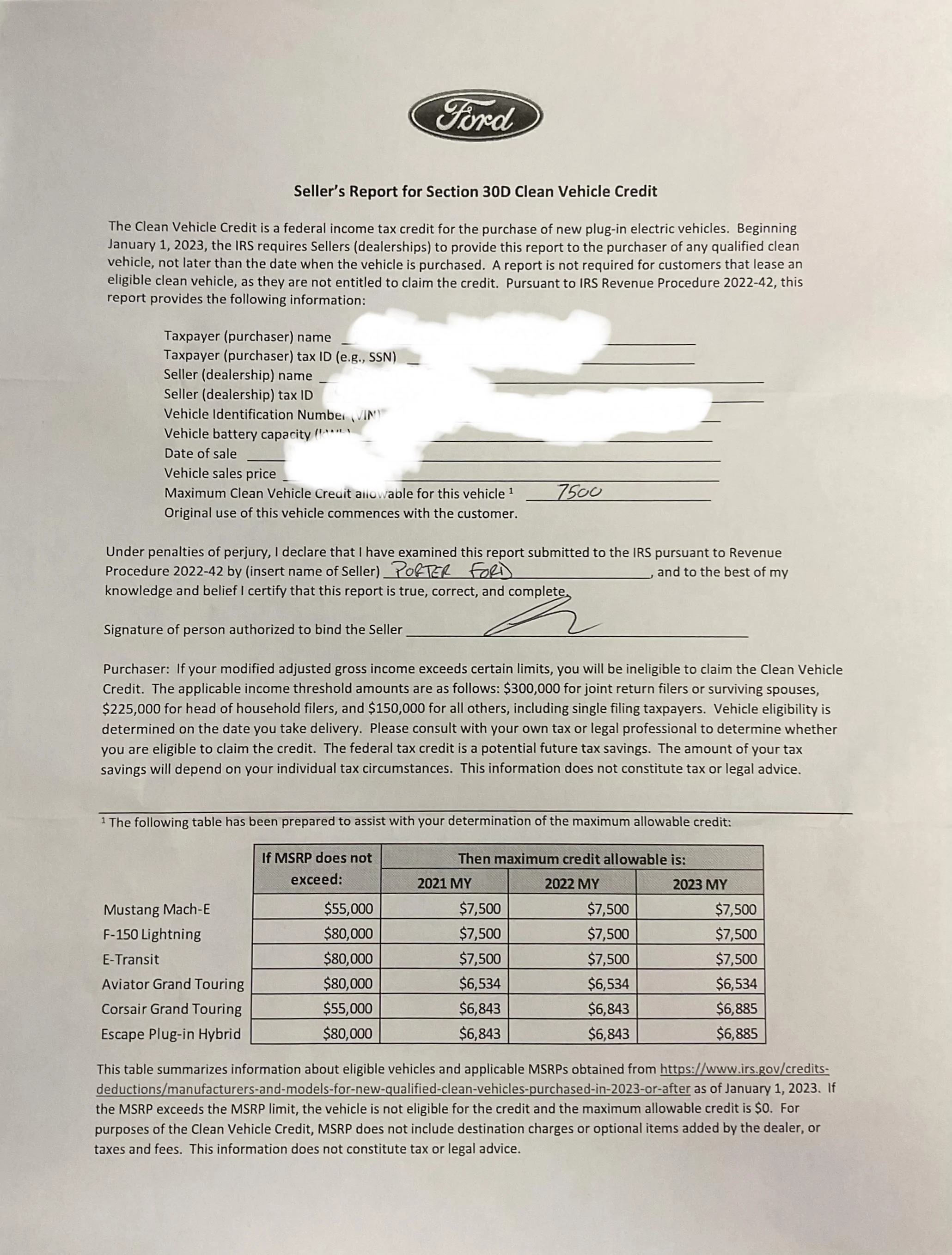

Little confused by what you mean. We are currently being incentivized to buy since they postponed the requirement. I honestly don’t think I would keep the truck without the inventive. $7500 is almost 20% of my purchase. Big chunk of change that I originally did not account for. I would prob take the truck and sell it.I do wonder sometime come March, would Feds be thinking, why do we need to give incentive to someone that has already bought his truck (Jan-Feb guys)?

Sponsored