pjy

Well-known member

- First Name

- Pat

- Joined

- Aug 12, 2022

- Threads

- 11

- Messages

- 60

- Reaction score

- 55

- Location

- Westchester Ny

- Vehicles

- F150 lightning

- Occupation

- LE

- Thread starter

- #1

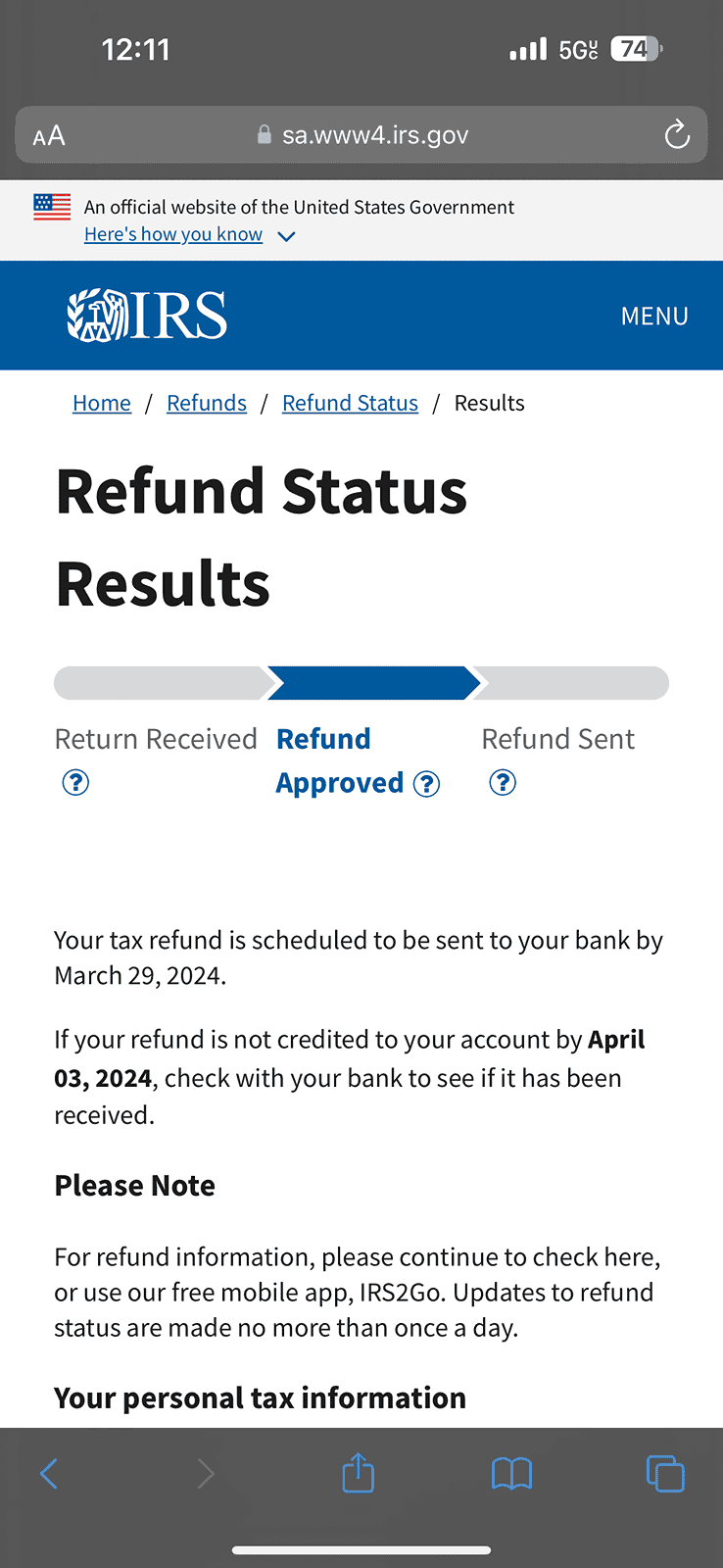

I submitted my 2023 taxes and now my accountant is saying they are not being accepted because my dealer did not submit form 15400 to the irs. I’m calling the dealer tomorrow but my CPA and the dealer seem to be clueless. Has anyone else had this issue and have a suggestion/resolution? I know there are threads but they are older.

Sponsored