jamelski

Well-known member

- Joined

- Aug 11, 2024

- Threads

- 9

- Messages

- 204

- Reaction score

- 312

- Location

- Sacramento

- Vehicles

- 2024 Lariat

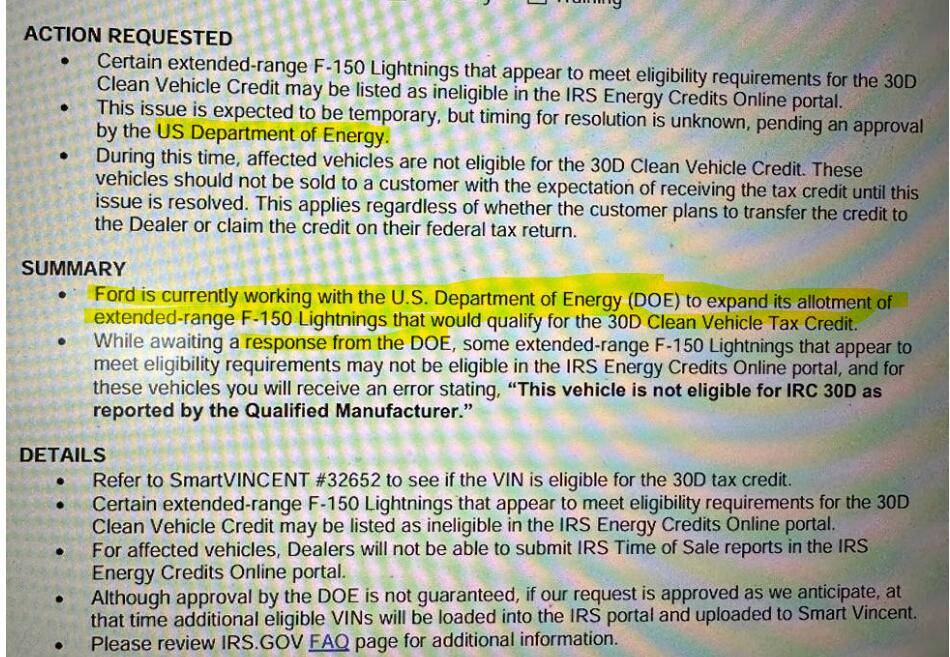

I’m not talking about a point of sale credit. I’m talking about if the dealer does not properly put your sale in the IRS tax credit system and you try to claim it at tax time you will not get the 7500 off your taxes many people have had this issue because they their dealer did not properly document their sales to the IRSThe IRS has contingencies steps you can follow if your dealer/seller did not give you the form, as long as Ford sent them the VIN, I think you can argue the point with your sales documentation, vin number etc. if they deny it...I was prepared to if needed although I didn't have to...

My dealer did not give me the form, and I was not sure if they had claimed it or not.

They took $7500 off on my sales document but it was listed as a down payment, not a tax credit, and when I took delivery they were not sure how to do the tax credit thing they said...

So I was in the dark - called them numerous times to try to get an answer but the finance person was always out or on the other line.

Anyway, ultimately, before tax filing, I was able to confirm they DID claim it by accessing my IRS files (not an easy task with all the security checks by a third party company required, but doable).

About a week later, the IRS sent me a letter informing me that I had transferred the tax credit according to their records, but that their records were wrong to let them know - apparently EV tax credit fraud is a big deal now with all the EVs being sold.

Anyway, the dealer is SUPPOSED to report the sale to the IRS, but if they don't, then what?

The facts are:

1) it is a qualifying vehicle and Ford should have reported the VIN to the IRS which proves it,

2) you can prove you bought it (all the sales paperwork) and did not transfer the credit

3) you pass the income test, so

4) I'd argue a missing piece of paper from the dealer because they were negligent should not be held against you.

A good chance you'd prevail I'd guess.

Sponsored