chl

Well-known member

- First Name

- CHRIS

- Joined

- Dec 16, 2022

- Threads

- 7

- Messages

- 2,356

- Reaction score

- 1,450

- Location

- alexandria virginia

- Vehicles

- 2023 F-150 LIGHTNING, 2012 Nissan Leaf, 2015 Toyota Prius, 2000 HD 883 Sportster

- Occupation

- Patent Atty / Electrical Engineer

I agree with the above.You should file a complaint with Ford, although in my experience they won't do anything to hold the dealership accountable.

In Colorado (I'm there too), once an auto sale is signed and you take delivery, the deal is 100% done. They can't go back and renegotiate the deal. If they screwed up and misrepresented the rebate, that's on them. They can't hold your title for ransom, they can't ask for more money, it's done. Do not give them the money. Tell them you expect the title to be delivered to you if you paid cash, or to your lien holder/lender if you financed and they have no right to hold it. You're probably done dealing with your salesperson at this point, or should be, and you should communicate directly to the dealership GM. Only communicate via email so there is written account of everything, nothing verbal over the phone.

The Colorado Dept. of Revenue has a specific automotive division to report to. Also file a complaint with the State Attorney General's office for automotive fraud. In the mean time, do everything else as you normally should like getting your plates/registration, etc.. If they're not releasing title work to enable that, tell the DMV as well so you get proper temporary/ extension/ etc..

If you still don't get anywhere, I can recommend a Denver-based attorney that deals with this sort of shit. Feel free to DM me. I went through a bad deal late last year, trying to buy a '22 Lariat ER demo/ mannequin.

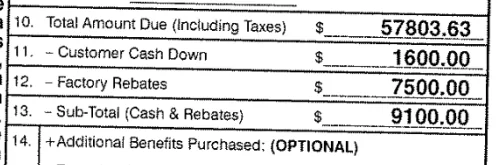

EDIT> Want to add a bit more about the deal being done and the rebate being their problem. It is *THEIR* responsibility to understand and offer these rebates. Ford makes it pretty clear. By them trying to pull this stunt now means that they misrepresented the deal and that is unacceptable. This is a "yo-yo" sales practice and outlawed most everywhere. Once the paperwork is signed, you drive the truck off the lot, the deal is done. Unless their is some provision in the sales paperwork that allows them to re-verify such things, which there is not or should not be, because it's not allowed here, then it's a done deal. The only way for them to get that $7500 back without straining the law and screwing with you in an unjust way is to request, if you're willing, to completely unwind the deal in which you give back the truck, they give back your trade and any down payment and all that.. Nope...

By get back the $7500, do you (the original poster) mean they gave you a price with $7500 discount off MSRP? Or did they give you $7500 cash/check at signing?

Either way it was in the deal as a discount, it SHOULD show up on a line on the sales contract.

Once the paperwork is singed by both parties, it generally matters not what anyone said orally beforehand unless there was a serious material misrepresentation (lie) constituting fraud, a rare exception, in most cases it is buyer beware, seller too.

If they don't deliver the title to lien holder or buyer, they have breached the contract and are subject to remedies that would include specific performance (delivering the title) and damages (attorney fees, court costs, etc.). The state could take away their license.

They probably didn't want to use email because email is considered 'in writing" and is admissible as evidence in court, stronger than he said/she said evidence which could be one person's word against another's.

As far as the tax credit goes, Dealers CAN only apply for it for LEASED vehicles, because they OWN the vehicle. BTW leased vehicles are not subject to the content/manufacturing content requirements because they are considered 'commercial' vehicles.

HOWEVER, the seller has to report the sale to the IRS for you to get the tax credit. I don't know what will happen if this dealership refuses to report to the IRS - make that a part of your settlement/judgement if you end up suing.

You may or may not get all or part of the tax credit when you file your 2023 tax return because of the way the law works - for example there is an income (Adjusted Gross) test:

-------------------

To qualify, you must:

- Buy it for your own use, not for resale

- Use it primarily in the U.S.

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

The sale qualifies only if:

- You buy the vehicle new

- The seller reports required information to you at the time of sale and to the IRS.

- Sellers are required to report your name and taxpayer identification number to the IRS for you to be eligible to claim the credit.

- $80,000 for vans, sport utility vehicles and pickup trucks

- $55,000 for other vehicles

(from the IRS web site: https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after )

-------------------------

Don't you just love dealships?!

Ford has made noise about selling EV's directly to consumers like Tesla.

I'd like that.

(PS: Disclaimer - I am an EE and an Attorney, but not licensed to practice in Colo. - seek competent legal advice by an attorney licensed in your state and do not rely on the above as legal advice.)

Sponsored