chl

Well-known member

- First Name

- CHRIS

- Joined

- Dec 16, 2022

- Threads

- 7

- Messages

- 2,206

- Reaction score

- 1,353

- Location

- alexandria virginia

- Vehicles

- 2023 F-150 LIGHTNING, 2012 Nissan Leaf, 2015 Toyota Prius, 2000 HD 883 Sportster

- Occupation

- Patent Atty / Electrical Engineer

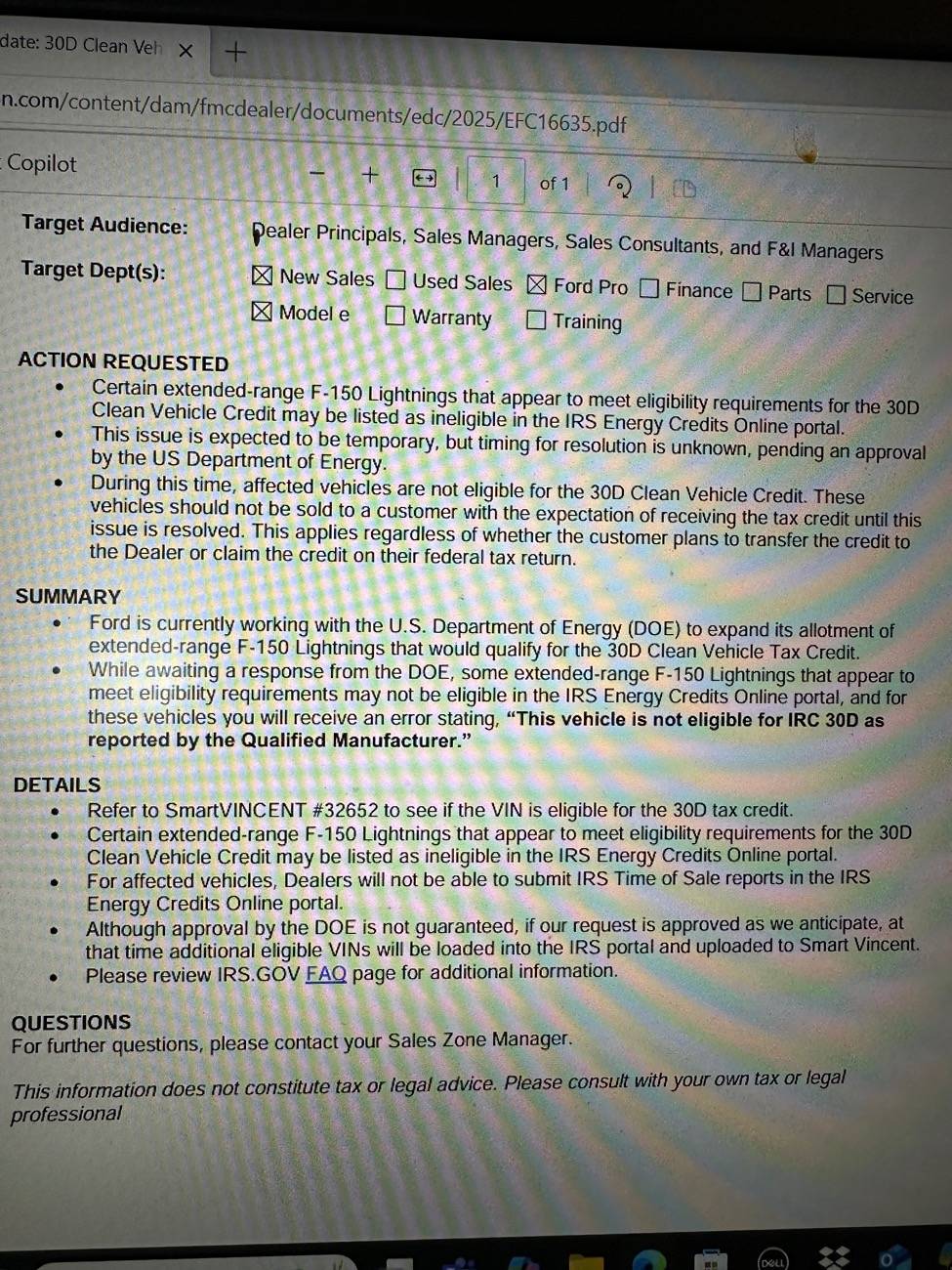

Maybe this FAQ (from the IRS web site) will help - if FORD did not report the VIN to the IRS, then it will come back as ineligible.

As others may have said, you can still TRY to claim the credit at tax filing time next April, keep all documentation to back up your claim (MSRP is the key info) and remember there is an income limit to qualify for the tax credit which can be this year or the previous year's income (more info on the IRS web site):

FAQs 15

Q15. I input a VIN for a vehicle identified by a qualified manufacturer as an eligible vehicle, but it came back as ineligible. Is this accurate? Who do I contact for additional information? Is there a list of vehicles that are eligible for the credit? (added July 26, 2024)

A15. Qualified manufacturers identify and report eligible VINs to the IRS. IRS Energy Credits Online provides real-time confirmation of a vehicle’s eligibility using VINs provided by qualified manufacturers. Qualified manufacturers submit VINs of qualifying vehicles which are matched to time-of-sale reports. If a qualified manufacturer has not provided the IRS with a VIN for an eligible vehicle, the time-of-sale report will be rejected until the manufacturer provides the VIN to the IRS. We are working with qualified manufacturers to ensure all eligible VINs have been submitted.

As others may have said, you can still TRY to claim the credit at tax filing time next April, keep all documentation to back up your claim (MSRP is the key info) and remember there is an income limit to qualify for the tax credit which can be this year or the previous year's income (more info on the IRS web site):

FAQs 15

Q15. I input a VIN for a vehicle identified by a qualified manufacturer as an eligible vehicle, but it came back as ineligible. Is this accurate? Who do I contact for additional information? Is there a list of vehicles that are eligible for the credit? (added July 26, 2024)

A15. Qualified manufacturers identify and report eligible VINs to the IRS. IRS Energy Credits Online provides real-time confirmation of a vehicle’s eligibility using VINs provided by qualified manufacturers. Qualified manufacturers submit VINs of qualifying vehicles which are matched to time-of-sale reports. If a qualified manufacturer has not provided the IRS with a VIN for an eligible vehicle, the time-of-sale report will be rejected until the manufacturer provides the VIN to the IRS. We are working with qualified manufacturers to ensure all eligible VINs have been submitted.

Sponsored