F150ROD

Well-known member

Same, looks like that form won't be out until that date at the latest.I do it on TurboTax and can’t get as the form isn’t available until 2/21/24. Waiting patiently

Sponsored

Same, looks like that form won't be out until that date at the latest.I do it on TurboTax and can’t get as the form isn’t available until 2/21/24. Waiting patiently

No need to wait, form 15400 will be used POST filing season for a programmed compliance review a year+ down the road, I doubt your claim for credit will be rejected in the interim.I’m waiting on confirmation from my dealer that they filed the 15400 form but it appears they did.

Yea thatI do it on TurboTax and can’t get as the form isn’t available until 2/21/24. Waiting patiently

yes my COA said they changed the password again he had to put in the vin number to get itAnybody who bought a tax credit-qualifying Lightning in 2023 already filed their taxes? I'm planning to do mine soon (I file by myself using Freetaxusa). Wondering if anybody's run into any surprises. I got confirmation from my dealer that they filed the 15400 form.

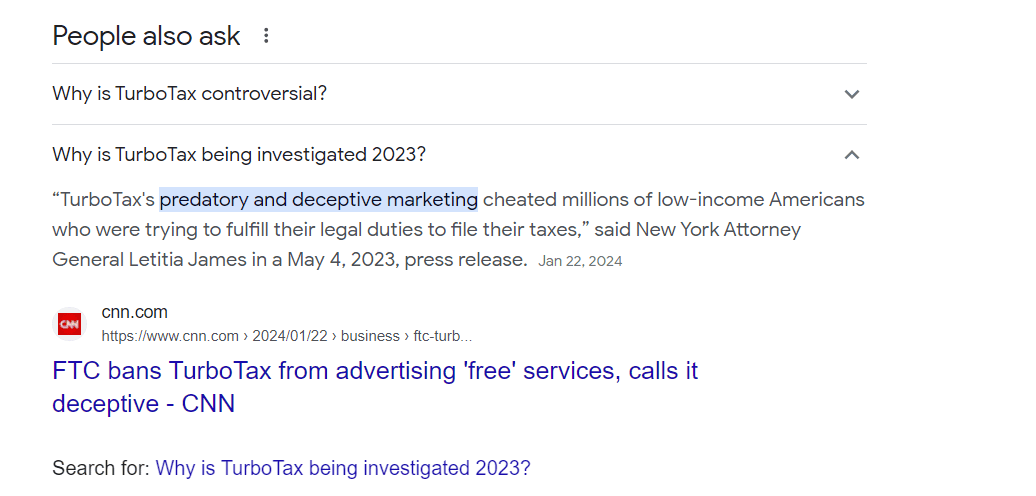

They are on the slow side of integrating the form revision into their processing system, BTW TT has been dropped as a favored E-file provider, the FTC has a beef with them.I was doing Turbo Tax also but after reading some conversations online, the tax form is ready and turbo tax is just taking their sweet time. They won't file until the 21st.

This year with the new IRA rules, if you live in an “Urban“ area you don’t qualify for the charging equipment credit. Bummer.Don't forget about Form 8911 to claim a tax credit for the lesser of $1,000 or 30% of the cost of purchasing and installing charging equipment.

That's both for 2023 and 2024...This year with the new IRA rules, if you live in an “Urban“ area you don’t qualify for the charging equipment credit. Bummer.

| Tax Year | 2023 |

| Filing Status | Married and filing jointly |

| Social Security number | xxx-xx-xxxx |

| Your refund amount | $x.xxx.xx |

| Deposit date | February 29, 2024 |