TreatYoSelf

Well-known member

- Thread starter

- #1

I'm curious what your state does for EV registration taxes. Please let us know!

Today, I registered our Tesla with the state of Colorado, and there seems to be an increase in EV-related fees. When I first registered an EV in 2020, it was a single $50 fee. This year, it's $69 divided between two fees. I understand that states traditionally use gasoline taxes to pay for roads and maintenance. My economics mind likes how the taxes on gas are efficiently applied; you drive more, use the roads more, buy more gas, and pay more taxes.

EV taxes are flat-rate, which is the most annoying part as a driver who doesn't drive a lot. Yes, I can afford it... and in Colorado we get a state tax break when we purchase an EV... but just let me complain ?

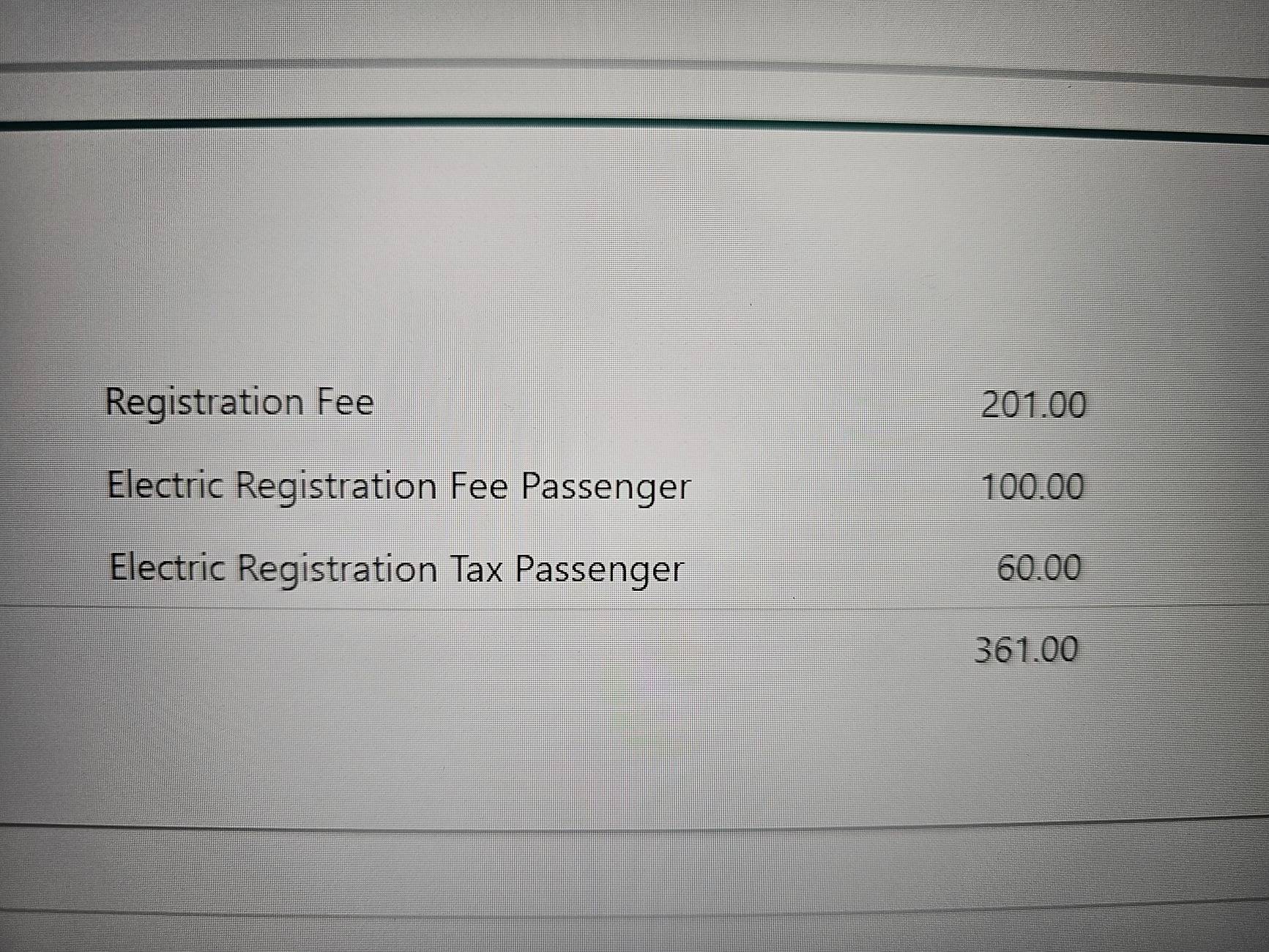

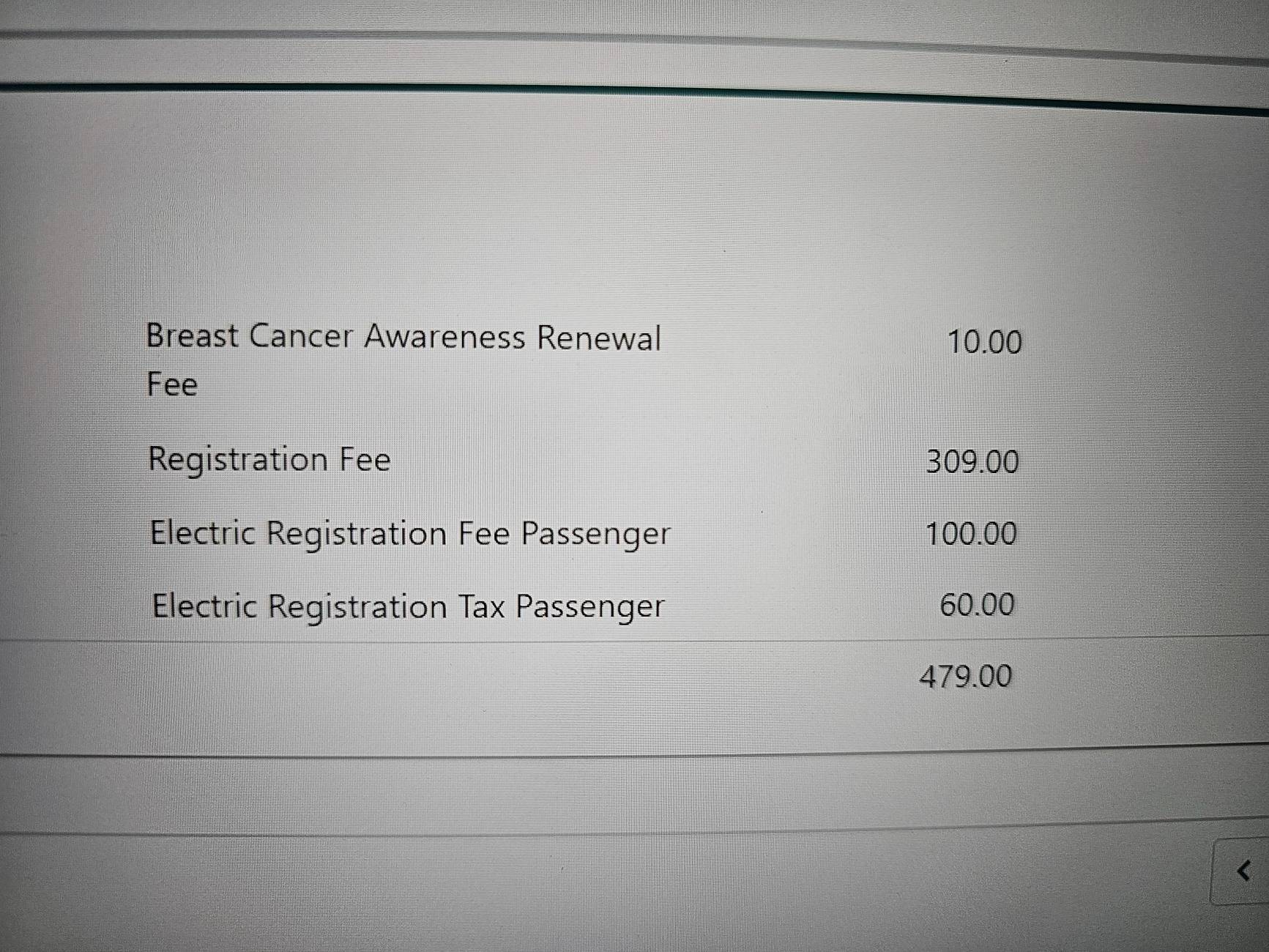

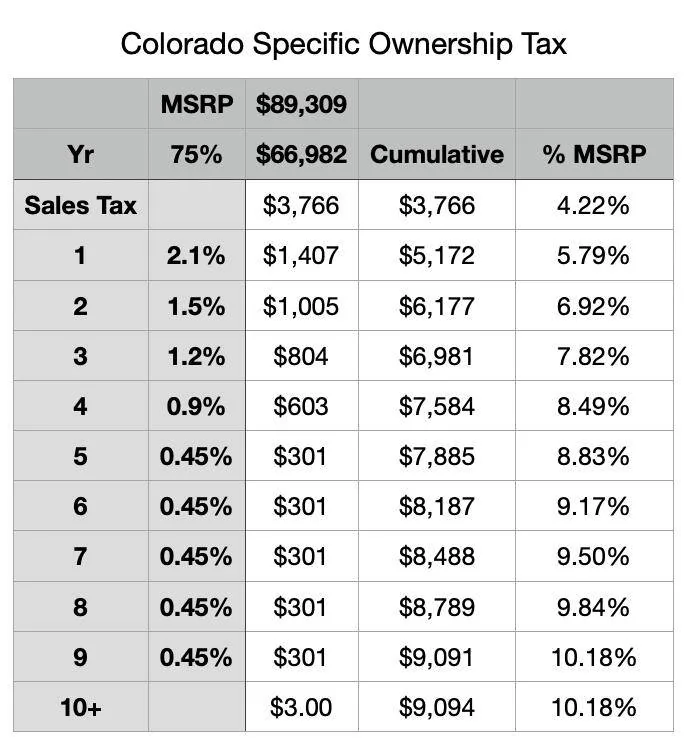

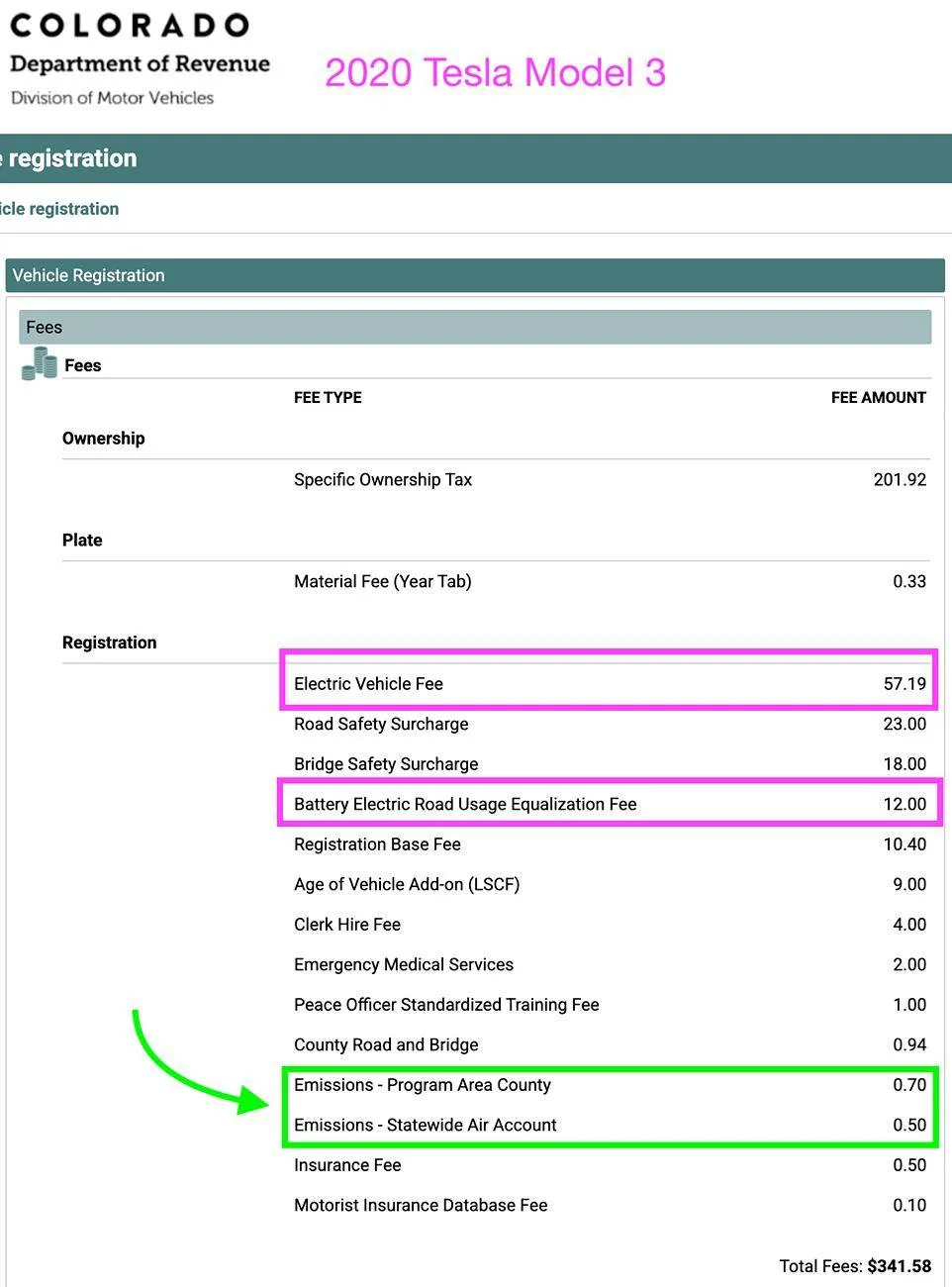

Here's Colorado's breakdown of registration fees for our 2020 Tesla Model 3. My new Lightning in 2024 rang in at an eye-watering $1213! Ironically, EV drivers still pay a fee for "Emissions" programs.

Today, I registered our Tesla with the state of Colorado, and there seems to be an increase in EV-related fees. When I first registered an EV in 2020, it was a single $50 fee. This year, it's $69 divided between two fees. I understand that states traditionally use gasoline taxes to pay for roads and maintenance. My economics mind likes how the taxes on gas are efficiently applied; you drive more, use the roads more, buy more gas, and pay more taxes.

EV taxes are flat-rate, which is the most annoying part as a driver who doesn't drive a lot. Yes, I can afford it... and in Colorado we get a state tax break when we purchase an EV... but just let me complain ?

Here's Colorado's breakdown of registration fees for our 2020 Tesla Model 3. My new Lightning in 2024 rang in at an eye-watering $1213! Ironically, EV drivers still pay a fee for "Emissions" programs.

Sponsored